Retail investors in India have various options to make investments to get better returns, such as equities, mutual funds, pension funds, and fixed deposits. Each of these assets provides an option to nominate a beneficiary who will receive the proceeds in the event of an investor’s unfortunate demise. However, the nomination process is neither uniform nor centralized for all the financial assets. In some instances, it is not even mandatory to provide the nominee for the asset.

1.0. Issues with Nomination

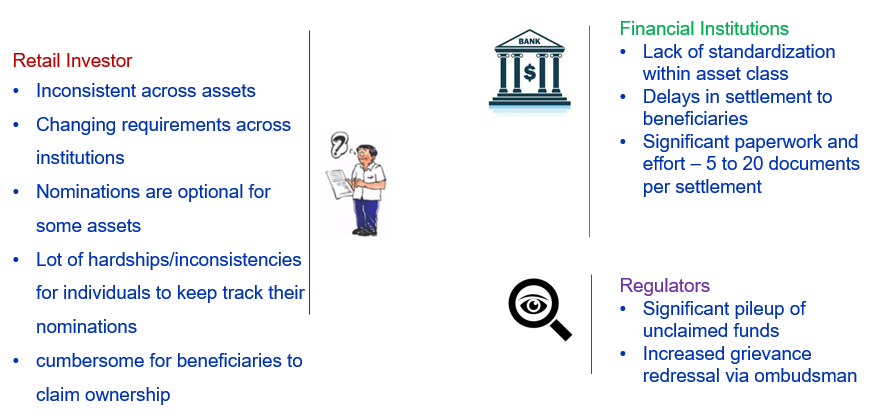

The stakeholders (such as retail investors, financial institutions, and regulators) face many issues in the absence of a unifying system. The retail investor may not have declared nominees for all (or some) of their financial assets, or the nominees cannot claim benefits when the retail investor is no more. Financial institutions have to go through a tedious documentation process to settle the claims, and regulators face increased grievance redressal.

The image below highlights the issues faced by various stakeholders.

The table below provides a snapshot of various assets and the approximate value of the unclaimed assets as of 30-March-2020.

These unclaimed assets provide significant financial hardships to the beneficiary, provide substantial overhead for financial institutions to process the claim and settlements, and regulators spend considerable time addressing grievances.

assets as of 30-March-2020.

| # | Assets | Approximate Value |

|---|---|---|

| 1 | Equities or Stocks | INR 28K Crores (3.9B USD) |

| 2 | Mutual fund Units | INR 24K Crores (3.2B USD) |

| 3 | Corporate Dividends | INR 5K Crores (676M USD) |

| 4 | Public Provident Fund | INR 40K Crores (5.4B USD) |

| 5 | Matured Insurance Policies | INR 15k Crores (2B USD) |

| 6 | Bank Accounts | INR 19K Crores (2.5B USD) |

| 7 | UTI Schemes | INR 11K crores (1.4B USD) |

| Total Value (approximately) | INR 1.4L crores (19B USD) | |

| Source Recoversy | ||

2.0. Unified Nominations Registry (UNR)

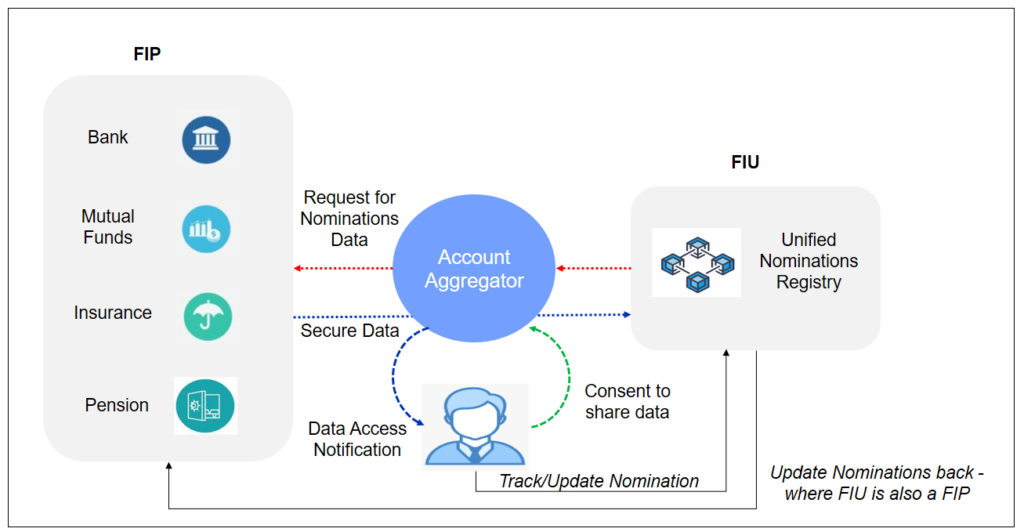

A UNR is a consolidated register of all declared nominees of a customer’s investments across different asset classes. An FIU, such as Personal Finance Manager (PFM), can provide this as an additional service (or primary service) to their customers and manage their customers’ nominees.

The FIU can request their customer to give consent and share their nominee’s details from their existing financial assets. The FIU will receive the data through the Account Aggregator framework and will maintain the nominees’ data. If the FIU is also a FIP, they can update the existing and future financial assets without their customer’s nominations with these nominees.

The Account Aggregator frameworks provide an excellent platform for unified nomination services, and any FIU (especially PFM) who is already a part of the Account Aggregator system can implement UNR. It will help retail investors declare nominees for their assets quickly and overcome the discrete nomination process followed by individual institutions. It will facilitate faster claims and settlements, which in turn will reduce unclaimed assets. It will also accelerate the claims and settlements process leading to a decrease in unclaimed assets. UNR with Account Aggregator provides multiple benefits, and it will bring us one step closer towards financial inclusion.

In the future, the UNR will allow customers to declare nominees for all their financial assets directly in the UNR that will reflect in their financial assets maintained with FIP. If a financial institution reports an asset inactive, they can reach out to nominees registered with UNR to start the claims and settlement process.

3.0 Technical Readiness

The latest version of the AA API specification (v1.1.2) has 26 schemas defined for various financial assets, and all of them have nominee data in the schema itself.

The nominee data is limited only to if a nominee is registered or not. The nominee details such as the nominee’s name, relationship with the account holder will be defined in the future versions of the schemas.

About The Authors

Karthikeyan Vedagiri has more than 15 years of experience in product engineering, specializing in solving IT and business challenges using technology. He has a bachelor’s degree in engineering with a specialization in electronics and communication from the University of Madras. You can reach him at karthikeyan.vedagiri@gmail.com.

Rajkumar Chandrasekaran has more than 19 years of experience in the field of large-scale product development. He is passionate about technology solutions used to impact the common man’s life. He has a bachelor’s degree in engineering with a computer science specialization from MS University, and you can reach him at rajkumarc2000@gmail.com.