The first annual event of the Account Aggregator (AA) community, ‘SamvAAd 2023 – Let’s Open Finance,’ was hosted by Sahamati. The event, held on 24th May ’23 in Mumbai, witnessed the participation of over 300 financial institutions from the four Financial Sector Regulators and the Technology Service Provider (TSP) community.

Nominations were called for across various categories, from AAs (operational and in principle) and TSPs. The winners in each category were allowed to present their solutions at the event.

IIFL, FinBox, and Finvu: Enabling access to short-term credit for MSMEs

The NBFC IIFL Finance and digital infrastructure company FinBox were awarded for building a cash flow and GST data-based unsecured business loan product for MSMEs.

FinBox, in collaboration with Finvu, became one of the first FinTech companies to adopt the AA framework in September ’21. They partnered with IIFL Finance in the same year to digitize their lending products, distribution channels, and partnerships.

Simplified, consented access to bank data

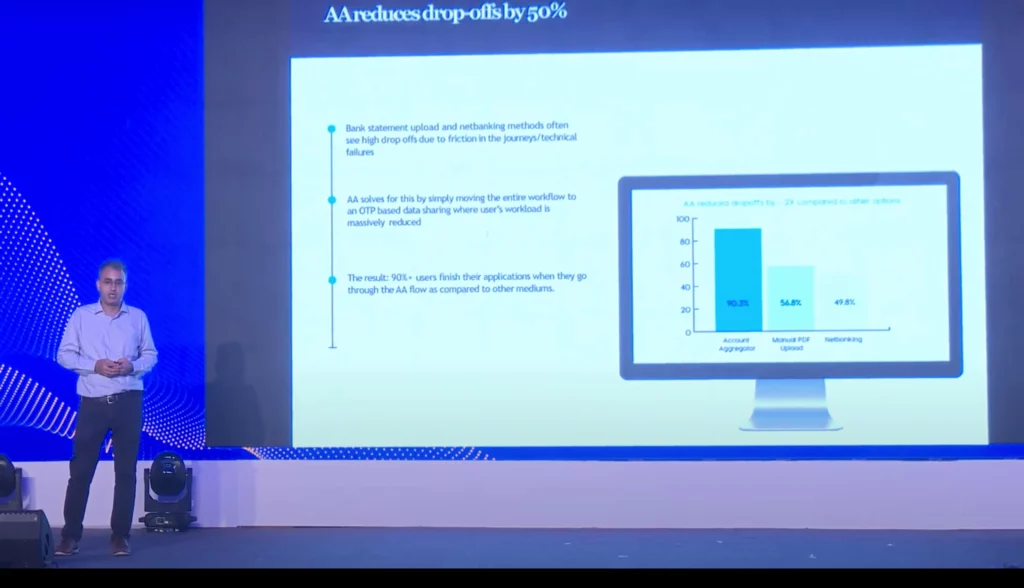

During the presentation, Mehekka Oberoi, Lead – Strategy, Founder’s office at IIFL, emphasized that only a few lenders offered MSMEs a fully digital lending experience. The unsecured lending process, in particular, was plagued by cumbersome documentation requirements and multiple manual checks, leading to high drop-offs during the bank statement upload stage.

The introduction of AA simplified this process by allowing Financial Information Users (FIUs) to access borrower data safely and with consent using just a phone number and OTP.

Through its integration with AA, FinBox enabled IIFL’s business loan applicants to share their banking, financial, and GST data in simple steps, facilitating comprehensive underwriting based on data points such as sales volumes, profit/loss, and vintage.

With the inclusion of GST data on AA from July, IIFL anticipates a higher number of eligible users and a smoother underwriting process, Mehekka added.

A seamless process, end-to-end

Mehekka then provided an overview of the loan application process, starting with a quick eligibility check. The steps involved were as follows:

- The user enters their mobile number and receives an OTP.

- The user authorizes a request to fetch data.

- IIFL accesses the user’s bank statements once the request is approved.

- Instant loan offers are generated.

- The user provides basic personal details with addresses pre-filled from bureau statements.

- The user provides business details and proof.

- e-NACH setup is initiated.

- IIFL reviews documents and disburses the loan within 24 hours.

Concluding thoughts from FinBox

Rajat Deshpande, CEO of FinBox, took the stage to highlight the untapped potential of AA. He emphasized the opportunities for early warning systems, pre-approved loan offers, and more in industries such as lending, insurance, and personal wealth management.

According to Rajat, AA creates substantial value for both borrowers and lenders. The cost benefits enjoyed by lenders translate into advantages for borrowers as well. AA lowers the cost of underwriting and loan processing, reduces the possibility of fraud, and makes the entire process faster, easier, and cheaper for borrowers.

We thank Finbox’s team and Mr. Rajat Deshpande for contributing to the blog.