Open Finance Roundtable - World Bank Spring Meetings 2024

As the industry alliance of the Account Aggregator (AA) ecosystem that ushers Open Finance in India, Sahamati recently participated in the Open Finance Roundtable World Bank Spring Meetings 2024 hosted jointly by the Financial Inclusion, Infrastructure, & Access (EFNFI) and the Consultative Group to Assist the Poor (CGAP) of the World Bank Group.

The roundtable aimed to initiate the development of high-level principles for Open Finance, gather feedback from participating authorities on key design elements, and provide regulators and ecosystem stakeholders a platform to share their experience and implementation approach. Participants across central banks, regulatory bodies, and relevant stakeholders from select jurisdictions contributed their insights and perspectives to the discussion.

The roundtable was structured into four thematic sessions: Objectives & Participation, Pricing & Costs, Governance, and Technical Infrastructure & Architecture. In each session, speakers shared their approaches, experiences, and challenges pertaining to the respective theme. A moderated discussion among the speakers followed the presentations. Sahamati participated in the Objectives & Participation session alongside Banco Central do Brasil, the Department of the Treasury, Australia, and the Korea Institute of Finance, South Korea.

Objectives of the Account Aggregator Ecosystem

Sahamati emphasized the core objectives of the Account Aggregator (AA) ecosystem, aiming to empower individuals & MSMEs with the autonomy to choose, the agency to act, and the flexibility over their entire financial life. Recognizing their data as “Digital Capital,” this approach shifts the perspective from data used solely to sell products or services to users to one where data is leveraged to empower the user. Effectively, data becomes a tool to access tailored services and unlock opportunities for economic advancement.

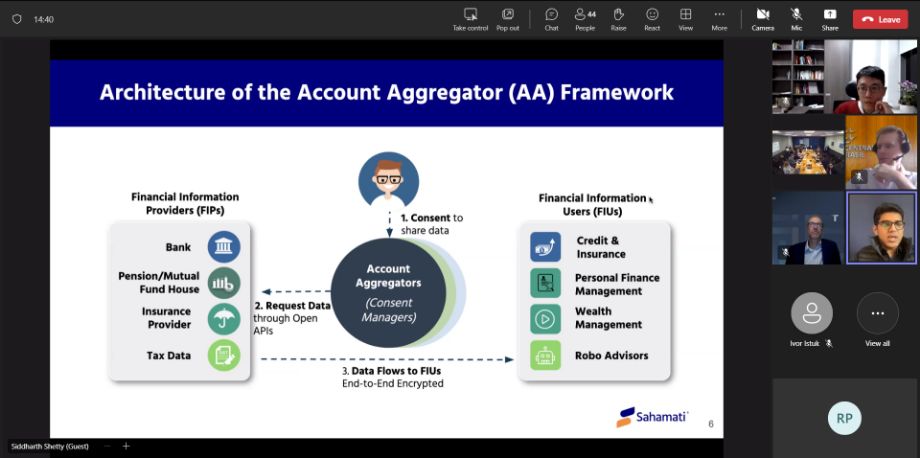

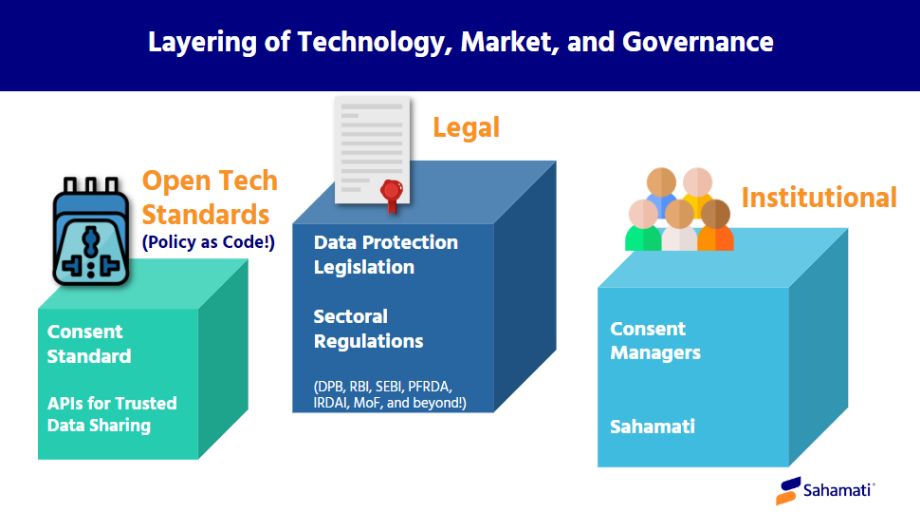

Techno-Legal Ecosystem of Account Aggregators (AAs)

Sahamati also elaborated on the techno-legal Account Aggregators (AAs) ecosystem in India, where the RBI NBFC-AA Master Directions 2016 is the regulatory foundation, complemented by sectoral regulations from the financial sector regulators (FSRs)– RBI, SEBI, IRDAI, and PFRDA. Additionally, the Digital Personal Data Protection Act (DPDP) 2023 is the legal backbone for the consent-based data-sharing ecosystem in India.

The ecosystem uses an open-source electronic consent artifact developed by MeitY, while the Reserve Bank Information Technology Pvt. Ltd. (ReBIT) provides technical specifications. As the market-led industry alliance, Sahamati spearheads collaboration and expansion. The most peculiar characteristic of the ecosystem is it’s built completely upon private capital! Together, these elements foster trust, efficiency, and inclusivity in the AA ecosystem.

Participation in the Account Aggregator (AA) Ecosystem

The Account Aggregator (AA) ecosystem is an innovation ecosystem of more than 500 financial institutions and technology companies across sectors! The ecosystem has showcased a 22% month-on-month growth rate in the last financial year.

As of 31st March 2024, the AA ecosystem includes 148 active Financial Information Providers (FIPs) with 16 financial information (FI) types live. These institutions have enabled more than 2.12 billion financial accounts, including 1.64 billion bank accounts, to use AAs for convenient, secure, and real-time consent-based data-sharing.

At the same time, 404 Financial Information Users (FIUs) leverage AAs to enhance customer experience. These institutions have already cumulatively fulfilled more than 63.95 million successful consent-based data-sharing transactions and linked 58.25 million financial accounts with AAs. As an outcome, the cumulative credit disbursed via AAs has crossed Rs 204 billion, with 40% allocated to MSMEs.

Innovative Use Cases of Account Aggregators (AAs)

AAs have enabled value creation that showcases the potential of data empowerment with innovative use cases such as:

- Business Correspondent-led “Assisted” Consent Experience: Leveraging Business Correspondents to facilitate consent processes enhances accessibility and inclusivity, particularly for individuals with limited digital literacy.

- Cash-flow Underwriting for Credit & Insurance: Utilizing cash-flow data accessed through AAs enables more accurate underwriting processes for credit and insurance products, leading to improved risk assessment and tailored offerings.

- Personal Finance Management (PFM) & Investment Advisory: AAs empower individuals with comprehensive insights into their financial data, enabling personalized finance management and informed investment decisions.

- Early Warning Signals and Risk Monitoring: By analyzing financial data in real time, AAs can provide early warning signals and proactive risk monitoring, enhancing financial stability and resilience.

- Identification of Un-nominated Financial Accounts and Retrieval of Unclaimed Assets: AAs facilitate the identification of dormant or unclaimed financial accounts, enabling individuals to reclaim assets and optimize their financial holdings.

- Monitoring Public Service Delivery & Welfare Schemes: AAs can play a vital role in monitoring public service delivery and welfare schemes, ensuring transparency, accountability, and effective governance.

These use cases showcase diverse ways to empower customers and contribute to the broader goals of financial inclusion and ushering trust in the digital economy.