The session with the second cohort of the COBOF- Cambridge Open Banking and Finance for Regulators Online Programme course was an engaging interaction wherein Sahamati provided an in-depth exploration of the evolving landscape of Open Finance and Open Banking to the participants, tracing its development over the last few years. The session highlighted India’s digital public infrastructure (DPI) approach to Open Banking and Open Finance. Participants included policymakers and regulatory representatives from central banks worldwide.

India’s implementation of Open Banking & Open Finance takes a different approach than the rest of the globe. India has unbundled payments and data-sharing into different ecosystems, namely the Unified Payments Interface (UPI) and the Account Aggregator (AA) framework. UPI has redefined P2P, P2M, and G2P payments in India. The AA framework is redesigning data protection in a user-centric manner.

The Account Aggregator (AA) framework ushers in a “user-centric” data-sharing paradigm predicated on the explicit, informed consent of the customer. The ecosystem provides customers with a convenient, safe, and secure way to access and control their financial data across banking, investment, insurance, pension, and tax systems. With AAs, customers can access, manage, and share data across all financial institutions (FIs) with explicit, informed consent. Effectively, the session discussed how the AAs empower consumers with the agency of their financial data to use for their benefit.

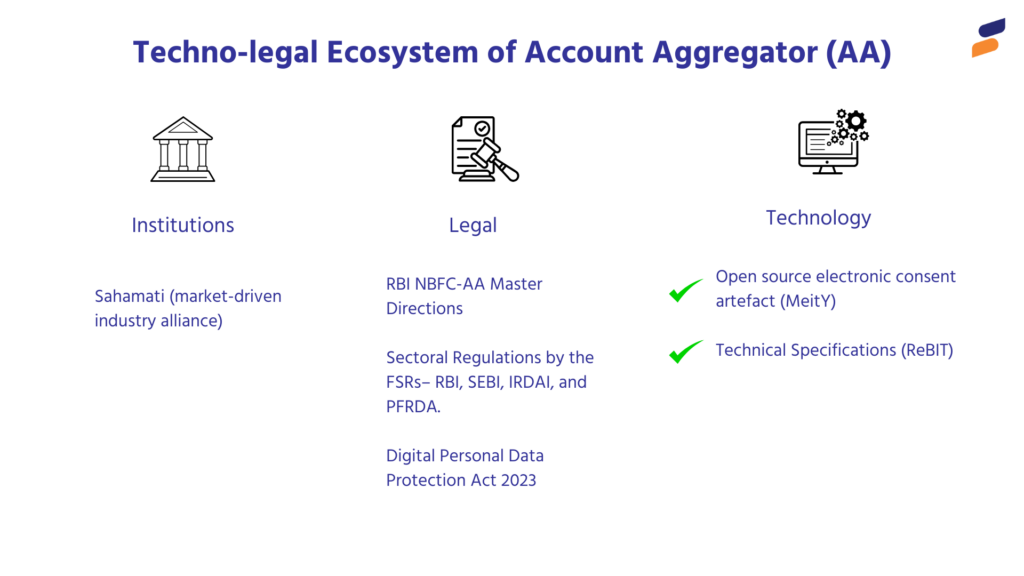

The session delved into the techno-legal approach for institutionalizing the AA ecosystem, across governance, technology, and market.

Governance: The Reserve Bank of India (RBI) regulates the account aggregator (AA) ecosystem in India under its Master Direction NBFC-AA, 2016, with oversight from other financial sector regulators such as SEBI, IRDAI, PFRDA, and the Department of Revenue.

Technological: RBI’s subsidiary ReBIT specifies the technical standards, including API protocols, data schemas, and security measures, while the AA framework incorporates the electronic consent artefact defined by the Ministry of Electronics and Information Technology (MeitY).

Market: The AA market includes a diverse range of participants from the entities regulated by RBI, SEBI, IRDAI and PFRDA representing a significant evolution in India’s financial services landscape.

Sahamati also emphasised the journey of the AAs to enlighten the participants about the status of the ecosystem. As of May 2024, there have been 79.96 million cumulative successful consent-based data sharing, a notable upswing from 10.52 million in May 2023. This highlights the maturity and reliability of the AA framework across sectors. The AA ecosystem has seen remarkable traction among users, evidenced by a month-on-month growth rate of 17.34% in cumulative successful consents.

The session concluded with demonstrations of various AA use cases, offering valuable insights for participants eager to learn how AAs are poised to revolutionize the management of digital footprints. These demonstrations highlighted how individuals can leverage their digital data as capital to access financial services seamlessly and affordably.