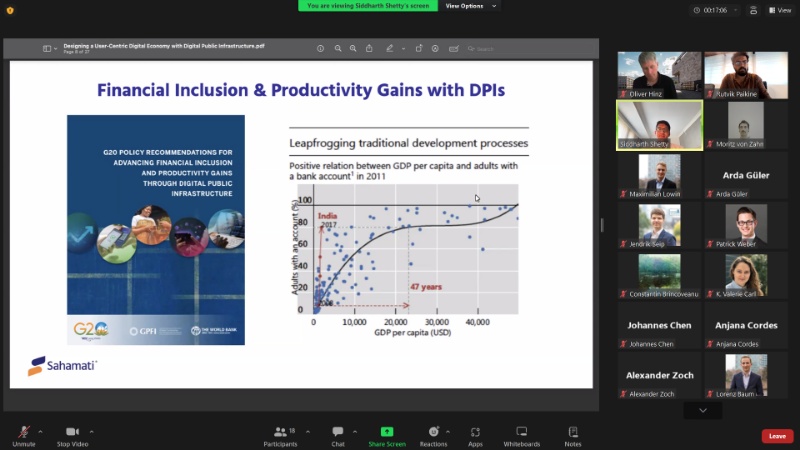

Understand the techno-legal framework of Digital Public Infrastructure (DPI) designed to create a user-centric digital economy. This approach addresses key trade-offs like stability and inclusion, regulation and innovation, and data protection and empowerment.

Designing a user-centric digital economy is a critical goal for policymakers and technologists in a rapidly evolving digital world. Sahamati was recently hosted at a Digital Finance Seminar by the Sustainable Architecture for Finance in Europe (SAFE) to discuss the transformative potential of Digital Public Infrastructure (DPI).

The session focused on the techno-legal implementation of digital public infrastructure (DPI) by managing institutional and customer interests at a societal scale. This balancing act involves tackling trade-offs such as stability & inclusion, regulation & innovation, and data protection & data empowerment. The Digital Public Infrastructure (DPI) approach involves solving these dilemmas by design. The session delved into the various population-scale initiatives in India as case studies for each set of trade-offs.

Stability and Inclusion: Aadhaar

Aadhaar, India’s biometric identification system, is a prime example of how DPI can foster inclusion while maintaining systemic stability. By providing a unique identity to over a billion people, Aadhaar has enabled individuals to access essential services such as banking, welfare programs, and healthcare.

Regulation and Innovation: Unified Payments Interface (UPI)

UPI, India’s real-time payments system, has revolutionized the financial landscape by enabling seamless peer-to-peer and merchant payments. UPI has exemplified the balance between regulation and innovation. The ecosystem is governed by regulatory frameworks that ensure payment flows are secure and regulated while fostering innovation that allows fintechs to develop innovative financial solutions.

Data Protection and Data Empowerment: Account Aggregator (AA)

The Account Aggregator (AA) framework tackles the delicate balance between data protection and data empowerment. The AA ecosystem allows users to share consolidated financial data from multiple institutions through explicit, informed consent. This facilitates access to better financial products and services.

These initiatives highlight how a techno-legal approach can orchestrate a digital economy that places users at its center, ensuring that the benefits of digital transformation are shared equitably.

For instance, the Open Network for Digital Commerce (ONDC) aims to democratize e-commerce by creating an open, inclusive, and transparent digital marketplace. It strives to provide equal opportunities for small and large enterprises, promoting a level playing field that fosters innovation while protecting consumer interests.

The insights shared at the SAFE seminar highlight the importance of a holistic approach that integrates technology and legal frameworks to address the complex trade-offs in a digital economy. By putting users at the center, DPI can drive inclusive growth, foster innovation, and ensure competition, setting a precedent for a future where benefits accrue to all stakeholders.