Decoding Account Aggregators

Shalini Gupta, Head of Strategy, Sahamati, appeared as a guest on the Decoding Impact podcast of the Sattva Knowledge Institute (SKI) hosted by Rathish Balakrishnan, Co-founder and Managing Partner of Sattva Consulting. The conversation delved into the Account Aggregator (AA) framework in India and its imminent impact on financial inclusion. Read the blog to know more about the themes the conversation delved into.

Account Aggregators: The Next Building Block of the India Stack

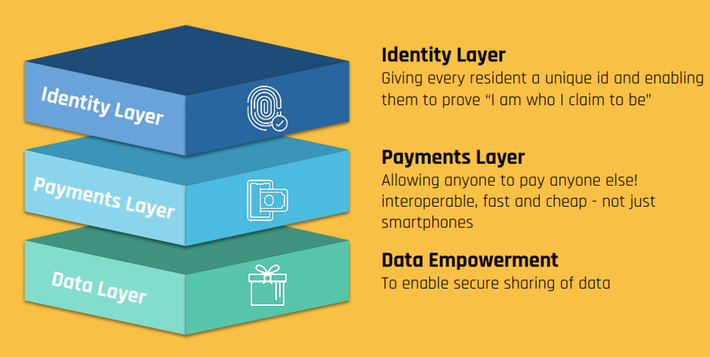

The Indian Digital Public Infrastructure (DPI), often called the India Stack, is a modular technological architecture composed of open API layers for identity, data, and payments. Account Aggregators, in this context, are a network of consent managers and data fiduciaries that enable customers i.e. data principals, to securely and digitally share their financial data with consent.

This data empowerment makes financial information portable, fostering data-sharing in regulated entities (REs) that can offer new financial products and services. In essence, it addresses the data friction currently hindering the financial sector and allows financial service providers to expand their reach to previously excluded population segments.

The shift from Physical Collateral to Informational Collateral

The Account Aggregator (AA) framework classifies data fiduciaries into two roles, namely, Financial Information Providers (FIPs) and Financial Information Users (FIUs) that operate on the principle of reciprocity. This means that institutions contributing data can also access data from others, expanding the breadth of financial information available for all the financial institutions and ushering in Open Finance in India.

Due to the large amount of cross-sectoral data accessible through the AA framework, physical-collateral-driven lending is poised to informational-collateral-driven lending. It enables lenders to access trust signals from a person’s financial accounts, making the lending process more efficient and reducing risk and cost.

According to the analysis undertaken by Sahamati, Account Aggregators (AA) hold the potential to grant credit access to 200 million consumers in India while bolstering lender viability and profitability. At the same time, banks and NBFCs deploying AA flows are projected to witness a substantial 50 percent surge in profitability over the coming five years. This transformative change paves the way for financial inclusion on an unprecedented scale and enhances lenders’ financial health.

Use Cases and Potential of Account Aggregators

The podcast also delved into the various cross-sectoral use cases of Account Aggregators. Currently, significant contribution to usage comes from banks and NBFCs as well as Personal Finance Management (PFM) and insurance use cases. Furthermore, the framework has also facilitated easier data sharing for loan processing, primarily functioning as a B2B experience currently. Still, plans are underway to expand to include B2C channels, further democratizing access to financial services.

PFM plays a pivotal role in helping customers understand their finances comprehensively, offering tailored financial products based on their requirements. This not only empowers customers but also enhances their financial literacy. Potentially, with AAs, the demand for better financial advisory services, fueled by the rise in discretionary spending in India, will be met.

Overcoming Hurdles in Adoption

The journey of Account Aggregators in India wasn’t without its challenges. Initially, private sector banks hesitated due to concerns about data sharing and security. However, feedback from early adopters, as well as government support and policy measures, has led to widespread adoption. The public sector banks have also recognized the framework’s value. They are experimenting with new use cases, shifting the perception from being net givers to net gainers from the AA roll-out and scale-up.

The Battle Between Traditional Banks and Fintech

The conversation touched upon the tension between traditional banks and fintech companies. While banks worry about their data being collected and used by fintech firms, the latter see themselves as benefiting from the data banks have collected. Shalini Gupta opined that it is crucial for the banks, particularly the public sector banks, to adopt technology to remain competitive.

AAs offer this opportunity for the banks to use customer data with consent and offer digital experiences and products that cater to their needs. It is important to note that only regulated entities (REs) in the financial sector can participate in the AA framework as financial information providers and users.

A Glimpse into the Future of Account Aggregators

The podcast concluded with insights into the evolving landscape of Account Aggregators. AAs not only improve transaction efficiency but also expand available information for decision-making. With the integration of GSTN in the network, efforts are underway to raise awareness among micro, small, and medium enterprises (MSMEs) to ensure they benefit from this framework.

Account Aggregators are rapidly gaining traction in India, promising a brighter, more inclusive financial future for millions of citizens. As this ecosystem continues to evolve, one can’t help but be optimistic about the transformative power it holds for India’s financial landscape, bridging the financial inclusion gap in the country. It showcases the power of technology and collaboration in reshaping the financial sector and making it more accessible.

To listen to the complete podcast, check out this link

Sattva Knowledge Institute (SKI) has published a report on the impact of AAs on the financial inclusion of women SHGs. Do give it a read!