Empowering Alternate Data Collection for Digital Lending with Account Aggregator Framework - Introduction

In this 2-part blog, we are going to explore some of the use cases in digital lending which can be empowered by RBI’s Account Aggregator Framework specifically in the context of alternate data gathering. But before I walk through the use case, it’s important to understand the larger goal of financial inclusion.

Today, millions of Indians are leaving behind a digital footprint by transacting online on various mobile payment apps and solutions. While they may not have achieved economic prosperity, they have become “data-rich” just because of the sheer volume of the data they are generating. Unfortunately, neither they have control of this data nor they can put this data to good use when in need leading to financial exclusion.

RBI’s Account Aggregator framework, which has been designed under the Data Empowerment and Protection Architecture (DEPA) aims to empower individuals with control over their data. The framework presents its opportunities not just in the financial sector but also in healthcare, jobs and urban data which are all instrumental in increasing the base of financially inclusive individuals.

To understand the importance of the AA framework, let’s look at the problem from a bird’s eye view by going through the following points:

- Financial Inclusion – why is it critical for any economy

- Credit Score, Credit Invisibility and how it leads to Financial Exclusion

- Alternate Data as a solution

In part 2 of this blog, I will cover the rest of the points:

- Challenges in gathering Alternate Data

- AA framework as a solution

- Lending Use Case with AA framework in action

Financial Inclusion

Financial inclusion may be defined as the process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low-income groups at an affordable cost… The various financial services include credit, savings, insurance and payments and remittance facilities.”

– C Rangarajan Committee on Financial Inclusion 2008

Financial Inclusion is vital for any economy; that has been stressed enough over and over again. Being able to have a transaction account is the first step towards financial inclusion as that enables the individuals and small businesses not just to send, receive and save payments it also enables the governments to pass on the benefits directly to those in need. No wonder Financial Inclusion is the focus of World Bank Group’s Universal Financial Access 2020 initiative which envisions that by 2020 adults globally should have access to a transaction account or electronic instrument to store money, send & receive payments.

And the need to have this initiative arose from the insights which were given out by the Global Findex Data (2017) which estimated one-third of the world’s adults as Unbanked. For India, even though we have remarkable progress in the last 5 years in terms of having a Bank Account the activity in those accounts is still quite low.

Consider this:

1. The number of Bank Accounts in India have moved from 35% to a remarkable 80% in just 6 years primarily due to GoI’s Jan-Dhan scheme; this is the same as that of China which has moved from 64% to 80% during the same duration.

| Bank Account Ownership (Age 15+) | |||

|---|---|---|---|

| 2011 | 2014 | 2017 | |

| India | 35.2% | 53.1% | 79.9% |

| China | 63.8% | 78.9% | 80.2% |

| Source: The Global Financial Inclusion, World Bank | |||

However, the Activity (marked by Deposits & Withdrawals in last 12 months) in those accounts stood at 42% whereas in China it’s at a healthy 74% (average of Withdrawals & Deposits)

| Bank Account Activity | ||||

|---|---|---|---|---|

| 2011 | 2014 | 2017 | ||

| Deposit in the past year (% with a financial institution account, age 15+) | India | 48.4% | 42.2% | |

| China | 83.5% | 71.5% | ||

| Withdrawal in the past year (% with a financial institution account, age 15+) | India | 41.7% | 43% | |

| China | 79.8% | 78.1% | ||

| Source: The Global Financial Inclusion, World Bank | ||||

2. And if we further drill down and look at the Credit numbers i.e. how many Indians have borrowed from a financial institution or used a credit card over the last 5 years, that number is still in single digits:

| 2011 | 2014 | 2017 | |

|---|---|---|---|

| Borrowed from a financial institution or used a credit card in India (% age 15+) | 9.1% | 8.1% | |

| Source: The Global Financial Inclusion, World Bank | |||

This points to the fact that a large part of the Indian population, even after having access to a bank account, remains unbanked and hence out of financial inclusion.

Credit Score, Credit Invisibility and Exclusion

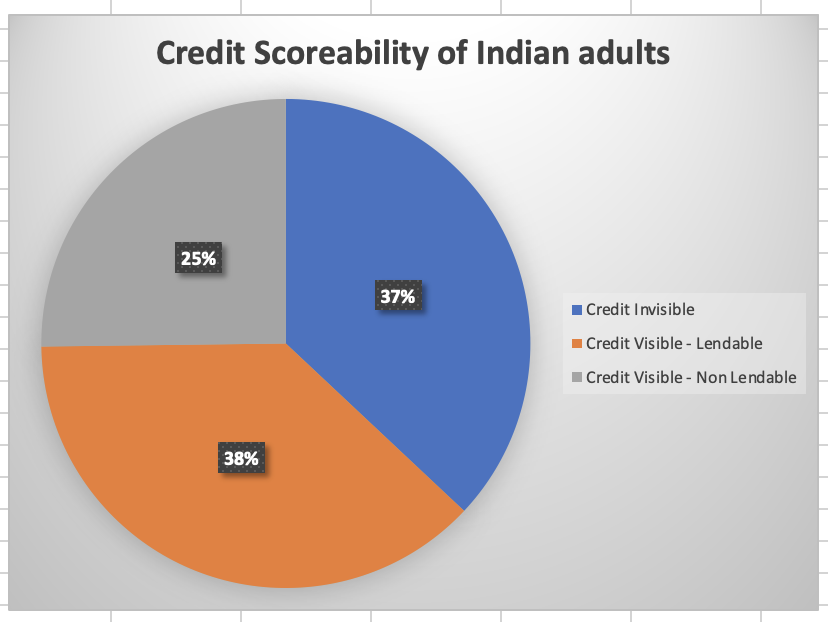

Consumer lending has been relying heavily on credit scores. In India, there are primarily 4 credit bureaus: CIBIL, CRIF, Experian & Equifax. While the awareness of credit score has risen in the last 5 years, as per World Bank’s data, 37% of Indian adults (70% of 1.3 billion = 900 million Total Adults) are still not covered by any of the private credit bureaus thereby making them “credit invisible”. This amounts to 300 million adults.

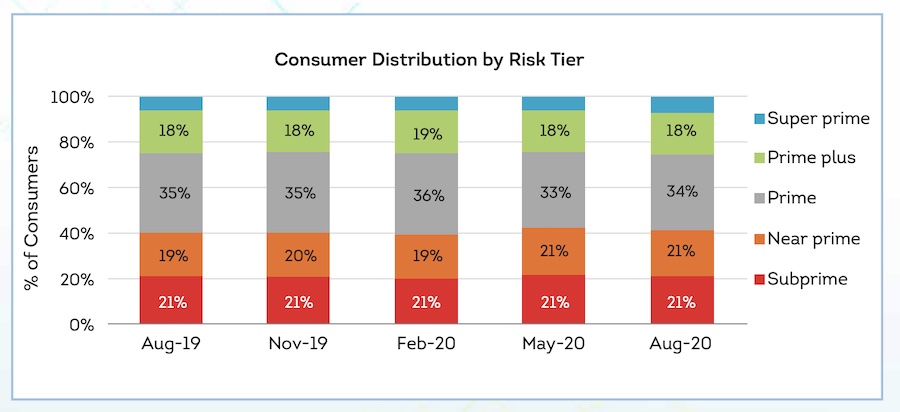

Having credit visibility is not sufficient to have access to credit as the credit scores are put in various risk tiers:

| Risk Tier | Borrower Transunion CIBIL V1 Score Range |

|---|---|

| Prime Plus | 801-900 |

| Prime | 751-800 |

| Near Prime | 651-750 |

| Subprime | 300-650 |

| Note: Non-Prime refers to the 300 to 750 range, the union of near prime and subprime | |

With 40% of credit visible population in Near-Prime and Subprime buckets, this is how the credit score-ability of Indian adults looks like

What this essentially means is that 62% of the population does not have access to formal credit resulting in these customers falling prey to loan sharks or informal credit and end up paying a much higher rate of interest than they ought to be.

What is Alternate Data

Alternate data is any data (digital or otherwise) which shows how the customers have been spending their money. This data can be used to predict various financial aspects about the customers like spending power, monthly expenses, future commitments etc. thereby helping in underwriting decisions by the financial institutions.

While the credit scores have evolved and they share a lot of data with the lenders apart from a score to base their underwriting on (trade lines, active loans, Days Past Due (DPD) across multiple loans and credit cards etc), most of the lenders rely on a “cut-off” score below which either they do not lend or lend at higher rate of interest to cover the risk. It’s important to understand two important points here :

- The credit scores do not predict the probability of default by an individual but they merely put the borrowers in a pool and the pool is expected to exhibit a particular default behaviour.

- The “cut-off” decision by the lenders is an economic decision which loosely translates to – “How many of the potentially default-able borrowers I can let in so that my profit generated by good paying customers is offset by the cost that the risky borrowers incur.” Beyond that “cut-off”, the risk costs start eating away the profit.

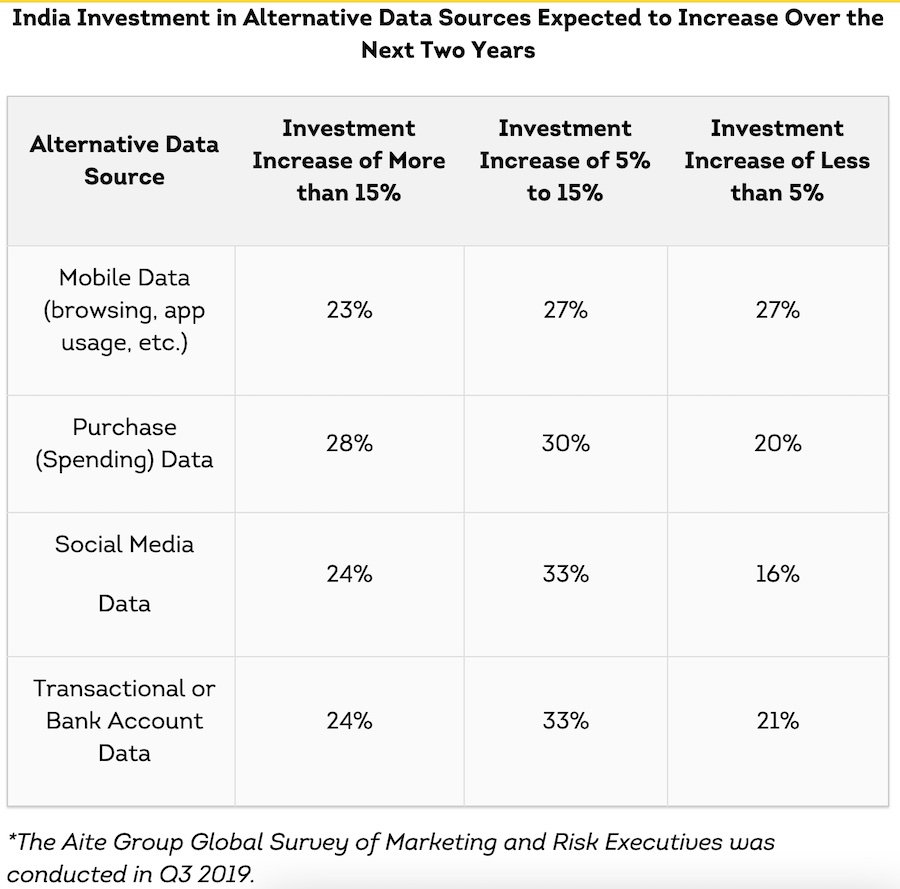

But because of these limitations, more and more institutions are investing their time and money in gathering “alternate data” digitally and are even finding it much more useful by complementing it with bureau scores. While some of this alternate data had been available and in use earlier as well, the source (OTT and online subscriptions) and medium(digital instead of physical) have changed. Some of the examples of alternate data are:

- Bank Account transactions

- Financial Assets like Mutual Funds, Fixed Deposits

- Rent

- Utility Bills like mobile/broadband, Domestic Cylinders/Gas

- Insurance Premiums

- Property/Real Estate records

- Income Tax

- GST

- Online subscriptions like OTT, Android/Apple

- Fuel Bills

Usage of Alternate Data for Financial Inclusion

A research study by Oliver Wyman rightly points at the two core benefits of using alternate data:

“For consumers, the use of alternative data provides two distinct benefits: first, more potential borrowers will be able to secure a loan, including many from among today’s credit invisibles. Second, most existing borrowers will have access to lower interest rates; that is, they will receive more favourable pricing because the small percentage of bad risks will be better separated from the good risks than is possible with traditional scores.”

And it’s not just borrowers who stand to benefit from the alternate data usage, lenders too can benefit; as the same study mentions:

“For lenders, the primary benefit of alternative data is the increased number of profitable loans to be made consistent with a given risk appetite. Additional benefits may include reduced transaction costs (additional borrower information could reduce the need for manual processes) and lower aggregate credit losses for any cut-off defined by a marginal loss rate. ”

Many private players, albeit outside India, have also expanded their product line to introduce alternate-data backed products like ExperianBoost and LenddoScore. While ExperianBoost is an optional service by Experian to boost your credit score (FICO) by voluntarily connecting your utility, telecom and video streaming services bills, LenddoScore is a proprietary credit score that takes non-traditional data into account while giving the customers a credit score between 1 and 1,000 (think data gathered from social media, browser, mobile phone, telcos etc).

We as a country have also taken note of it and while a lot of new-age fintechs and lending institutions are already using the alternate data, almost all of the Indian institutions (99%) surveyed in the TransUnion 2019 survey, plan to use alternative data which is higher than the global percentage of 89% over next 24 months.

Conclusion

At this point, it’s safe to conclude that with more and more alternate data getting generated per user, it’s imperative to turn our focus towards collection and dissemination of the same in order to lend to a wider ‘credit invisible’ population of the country. But this is easier said than done and is still rife with challenges, something that we will cover in the next part. And we will also cover what role AA can play in mitigating those challenges.

About The Author

Mohit Arora is a product manager who is deeply passionate about building customer-centric products which lie at the cusp of finance & technology, harnessing data and collaborating across teams to develop propositions, strategies and processes that are highly-relevant and deliver tangible value.

In his present role, Mohit is leading a product team at PayU Credit which is a credit arm of PayU in India and owns the brands of LazyPay and PaySense.