Workshop on Account Aggregators (AA) for the Regional Rural Banks (RRBs)

The National Bank for Agriculture and Rural Development (NABARD) organized a national workshop at the Bankers Institute of Rural Development (BIRD), Lucknow. This workshop brought together officials of various Regional Rural Banks (RRBs) to understand the Account Aggregator (AA) framework and it’s functionality to streamline their current processes. The workshop witnessed participation from 70+ officials representing 43 Regional Rural Banks (RRBs) from different parts of India, all with a shared vision of driving financial inclusion through innovation.

Sahamati participated in the event, presenting the potential of Account Aggregators (AAs) for the Regional Rural Banks (RRBs) to expand financial inclusion in the country. We were excited and honored to be a part of this significant milestone The presentation by Sahamati at the workshop focused on several key areas that are shaping the financial landscape in India:

-

An Overview of the Account Aggregator (AA) Framework

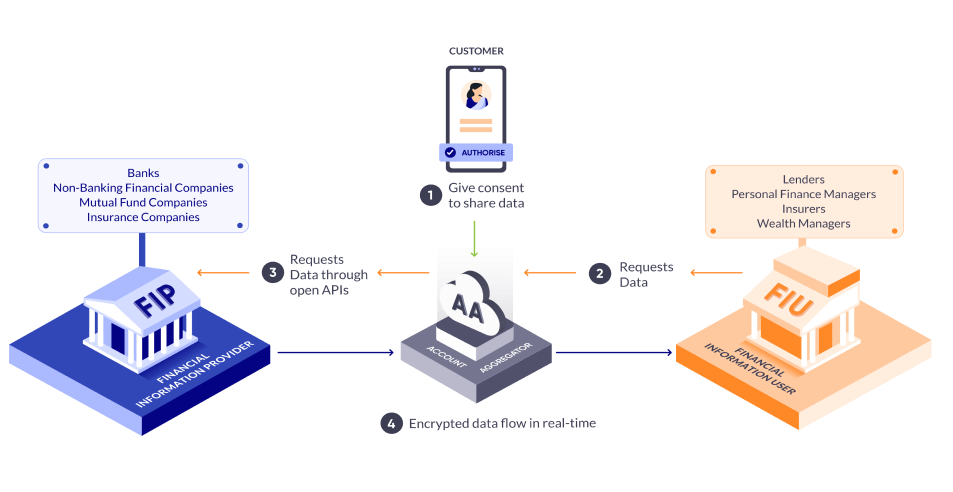

We presented an overview of the Account Aggregator (AA) framework and its core principles, such as collection limitation, purpose limitation, usage limitation, granularity of data access, notice to the data principal, and revocation of consent, which align with the Digital Personal Data Protection (DPDP) Act 2023. We shed light on how this techno-legal framework will usher in a new era of data sharing. At the same time, we emphasized the AA framework’s cross-sectoral and cross-functional nature.

-

The Current State of the AA Ecosystem in India

As the workshop progressed, we delved deeper into the current state of the AA Ecosystem in India, including the various types of financial information users (FIUs), financial information providers (FIPs), account aggregators (AAs), technology service providers (TSPs) and other allied entities such as certifiers and Online Dispute Resolution (ODR) providers of the AA Ecosystem. Similarly, the workshop highlighted the cross-sectoral FI Types live on the network. The discussion also touched down upon various other FIPs, such as GSTN, which we are in talks to onboard on the network, such as the Central Bureau for Direct Taxation (CBDT) and Employee Provident Fund Organization (EPFO).

We shared the remarkable progress reported to us by financial institutions employing AAs in their workflows. This market feedback illuminated the framework’s enormous potential to increase efficiency, reduce fraud rates, increase the top line of businesses, and significantly shrink turnaround times (TATs).

-

Phygital and Digital Journeys

One of the most exciting aspects of the workshop was our exploration of the ‘phygital’ and digital journeys that are driving the AA framework’s implementation. The fusion of physical and digital experiences has made AA accessible and convenient for everyone. This fusion is reshaping how consumers in the rural areas, which are extremely relevant for the RRBs, interact with the process of sharing financial information with the financial institutions, making it more user-friendly and efficient.

-

Real-world demonstrations and Use Cases

What’s a workshop without real-world examples? We were thrilled to showcase various demos and practical use cases that highlight the power of the AA framework. These case studies and testimonials from those who harnessed the AA framework to revolutionize their financial operations testify to its transformative potential.

-

Q&A Session

The workshop concluded with engaging interactions with the officials from different RRBs. The Q&A session allowed the RRB officials to voice their challenges and concerns about implementing the AA framework. It was a forum for collaboration and knowledge sharing.

Our participation in this workshop reflects our deep commitment to the growth and development of the financial sector in India. We firmly believe that the Account Aggregator framework has the potential to drive financial inclusion, streamline processes, and enhance the overall customer experience. This isn’t just about innovation; it’s about unlocking the future of finance.