ReBIT publishes GSTN Data Schema for the Account Aggregator Framework

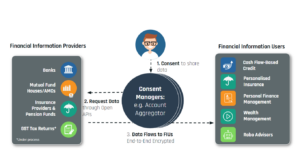

In the latest development, REBIT has added GSTN as a new Financial Information Type under the AA Framework and has released the data specs and schemas (click here for the latest GSTN schema).

This paves the way for GST Returns to be made available on the AA Framework, thus marking a huge step forward to addressing the significant gap in MSME lending in India. To put it in perspective, as per experts, only 15-20% of the MSMEs in India are estimated to have access to credit, and the annual credit gap for MSMEs is estimated to be as high as Rs 20-25 lakh crore.

In September 2022, RBI notified GSTN as a financial information type under the Account Aggregator Guidelines (including the Department of Revenue, under the Ministry of Finance, as one of the regulating entities). Post this, GSTN initiated the implementation efforts and completed its integration with multiple Account Aggregators based on available draft data schemas. With ReBIT officially releasing the GSTN data schemas, we expect GSTN to complete its testing and go live on the AA Framework as a FIP over the next few weeks.

Key Features of GSTN Specs on the AA Framework

What category of taxpayers can share GSTR via AA?

Regular taxpayers (Normal, SEZ unit, SEZ developer, opted in/opted out taxpayer, and casual taxpayer) whose status is Active when the details are being shared. The facility will be available to taxpayers irrespective of entity types, such as sole proprietorship, partnerships, and private and public corporates.

Who will provide the consent for the taxpayer?

Primary Authorised Signatory, whose mobile number is seeded in GSTN Records, will provide consent to share GST data with any potential FIU. If the mobile number of the taxpayer is seeded in the GST records as the number of the primary authorized signatory, it will be the taxpayer who will provide the consent.

What GST information is made available through AA?

- GSTR 1 (Table 4): Monthly or quarterly statement of all Outward Supplies to be furnished by all registered taxpayers

- GSTR 3B: Monthly or quarterly Self-declared summary GST Returns

- Return Filing Details

- Basic Profile Details, which include address, Legal name of the entity, and PAN, among other details

What period of GST data is made available through AA?

Data will be made available for a period of 18 months. The gap between “From” and “To” cannot be over 18 months. Further, data will be available for the completed returns filed during the period for which data is sought and not for a part of it.

Illustration: Data Consent shared for the period from 08/02/2022 (8th Feb 22) to 07/01/2023 (7th Jan 23) – In this case, the complete return period shall only be from Mar 2022 to Dec 2022. As the data is requested ‘from’ 08/02/2022, Feb 22 month is required to be ignored as it is not the complete month; likewise, the ‘to’ date is till 07/01/2023, and the Jan 23 month is required to be ignored as it is not the complete month. In case the return filing frequency is quarterly, then the data shared will be for three quarters from Apr-Jun 22, Jul-Sept 22, and Oct-Dec 22, and if the return filing frequency is monthly, then the data will be shared for the months of Mar’22 to Dec’22

Is GST data sharing enabled for both one-time or recurring?

Both one-time and recurring data fetch of the taxpayer’s consent is enabled. Recurring data fetch frequency has to be aligned to the return filing frequency of the taxpayer.

Are there any limits on GST data fetch?

For each session ID for data sharing to GSTN FIP, the maximum data that can be shared is 5MB.

What are the Identifiers used in the Discovery of GSTINs?

The AA will need to send two identifiers: The mobile number of the Primary Authorised Signatory and the PAN of the GST Taxpayer to GSTN to discover all active GSTINs registered with the combination of these identifiers.

Discovered GSTINs will be sent by the FIP and displayed by the AA in a masked form, similar to a bank account number. The portion of PAN in GSTINs will be masked. For example, the masked GSTIN will be returned as 01XXXXXXXXXX1ZN.