| ||||

CEO’s DeskThe financial services landscape is witnessing a profound transformation, driven by timely, secure, and consent-based data sharing through the Account Aggregator (AA) ecosystem. To reaffirm this development, we are pleased to announce the release of the Lending Report for H1 FY25, which highlights this evolution. The report reveals that 10.52% of all personal loans were facilitated through the AA framework—a strong testament to its growing adoption. This release coincides with a pivotal regulatory development: the RBI’s decision to invite applications for a Self-Regulatory Organization (SRO) for AAs. We welcome this step, as it marks a significant stride towards strengthening the governance of the AA ecosystem. As AAs continue to redefine financial data sharing, another technological force is reshaping the industry—our friendly digital ally Artificial Intelligence (AI)! While AI has been forcing us to rethink the processes of multiple sectors, the financial services industry is also now at the forefront of its adoption, leveraging AI to drive efficiency, personalization, and risk management like never before. The convergence of AI and AA presents a potential frontier—where intelligent algorithms can analyze consented, aggregated, varied data types to unlock deeper financial insights, streamline lending decisions, and enhance fraud detection. This synergy is accelerating digital transformation and paving the way for greater financial inclusion. The teamwork will not only accelerate digital transformation in the financial sector but also democratize access to advanced financial services. By enabling more accurate risk assessments and personalized offerings, this technological convergence is breaking down barriers to financial inclusion, particularly for individuals and small businesses that have been traditionally underserved by the formal financial system. As we navigate the future of finance shaped by emerging technologies, the next crucial step is to enhance awareness and accelerate the adoption of Account Aggregators (AAs). To propel this mission forward, Sahamati is launching a dedicated awareness campaign—an initiative aimed at educating and empowering users through diverse content formats, including podcasts, short- and long-form AV content, an explainer series, and more. We invite ecosystem stakeholders to collaborate and contribute to this effort, helping individuals fully understand the transformative potential of AAs in financial empowerment. If you’d like to be part of this initiative, reach out to us at info@sahamati.org.in. Together, let’s continue building an inclusive, responsible, and innovative financial ecosystem—one where individuals can truly harness the power of their data for a stronger financial future. | ||||

Key Stats

| ||||

| ||||

| ||||

Sahamati Monthly Recap:

In February 2025, significant enhancements were implemented to prepare the sandbox and support the Proof of Concept (PoC). Key technical improvements included integrating Keycloak with Superset (MIS & SaaNs) for user authentication, and establishing system monitoring using Prometheus and Grafana. Automated email notifications were introduced to alert users about entity secret expirations, while Discord-based alerts now inform teams about high CPU/memory usage and service restarts. Additionally, security measures were bolstered by upgrading Keycloak from version 16.1.1 to 26.0.7 and addressing critical findings from Vulnerability Assessment and Penetration Testing (VAPT). These efforts collectively enhanced system performance, security, and reliability. Read More..  The Central Registry onboarding documents have been updated to align with Fair Use guidelines, expanding the Consent Parameters Table in the Customer Experience Checklist to include attributes from the Fair Use Template Library. Participants must include their AA in onboarding requests, as consent screens are proprietary to AAs and their involvement is critical for seamless implementation. All other processes remain unchanged, and the revised checklist is attached for reference, with the updated document soon available on GitHub. Read More.. | ||||

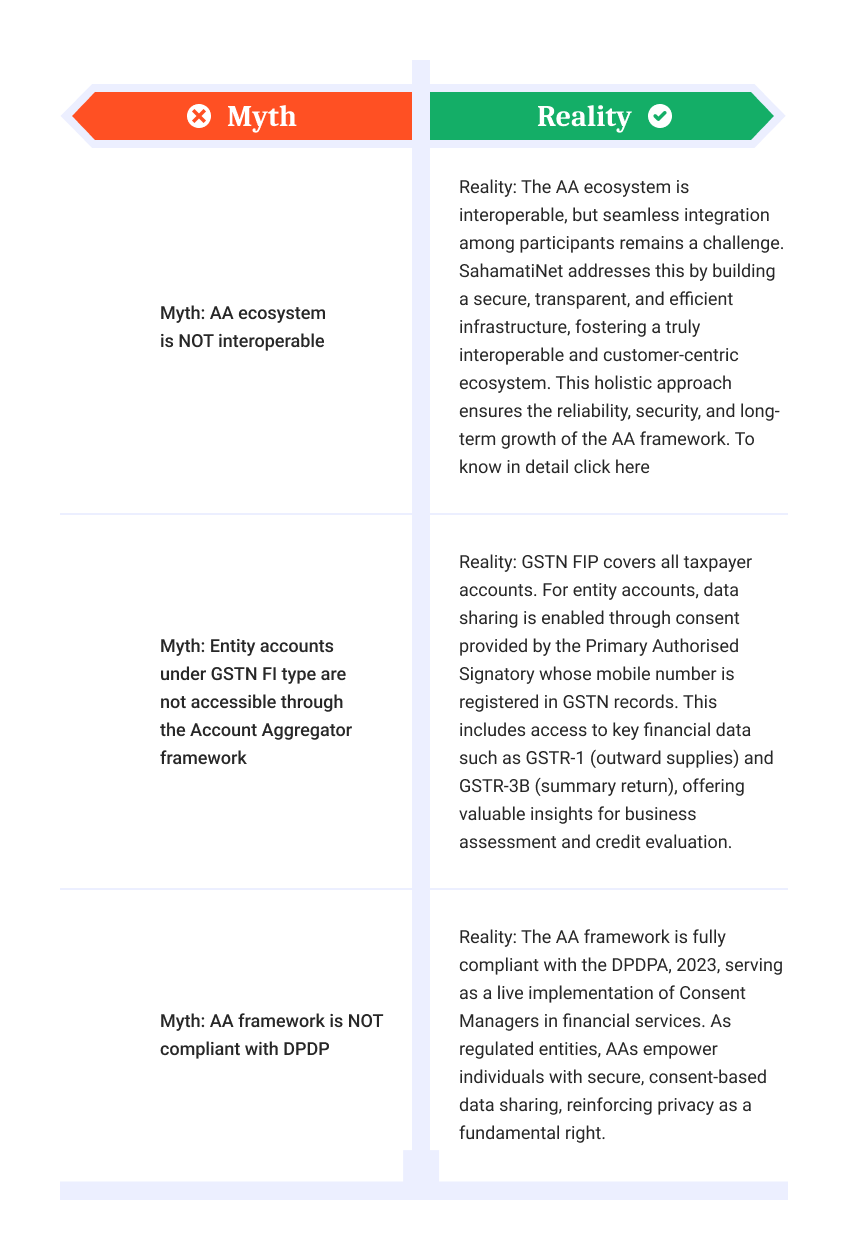

AA Bytes: Common Myth-Busters | ||||

Subscribe to our monthly newsletter (Get the Latest updates straight to your inbox) Connect to an AA today, visit https://sahamati.org.in/aa-apps/ Reach out to us @ https://sahamati.org.in/contact/ |