On average, every Indian manages approximately four financial accounts across financial sectors. This calculation is derived from the total of 3.50 billion financial accounts across bank deposits, insurance, mutual funds, securities, pensions, and GST, per capita of the adult Indian population of 800 million. Aggregating and analyzing consumer data from multiple financial accounts can provide a comprehensive snapshot of a consumer’s needs, income, savings, and behavior. These insights empower consumers and offer more accurate information to financial institutions, creating a win-win situation for both.

The RBI-regulated Account Aggregator (AA) Framework is pivotal in this transformative journey. This framework places the control and agency of “Data Capital” firmly in the hands of consumers. Through consent managers, known as Account Aggregators, consumers consent to the purpose, extent, and duration of data sharing with a chosen financial services provider in a secure, digital manner. With mandatory explicit consent, the process maintains high data privacy, safety & security.

Currently, 400 financial institutional integrations span four key financial sector regulators, including the Reserve Bank of India (RBI), Securities & Exchange Board of India (SEBI), Insurance Regulatory & Development Authority of India (IRDAI), and Pension Fund Regulatory & Development Authority (PFRDA), along with the Department of Revenue (DoR), Ministry of Finance (MoF), are active on the Account Aggregator (AA) network.

These institutions collectively empower over 1.94 billion financial accounts, constituting 56% of the total in India, to share data through the Account Aggregator framework. Over 34 million accounts have already been linked, representing 1% of the total financial accounts. In a testament to the success of this framework, consumers have seamlessly shared their data for purposes such as accessing loans, securities, insurance, and advisory services.

Year-on-Year Comparative Statistics

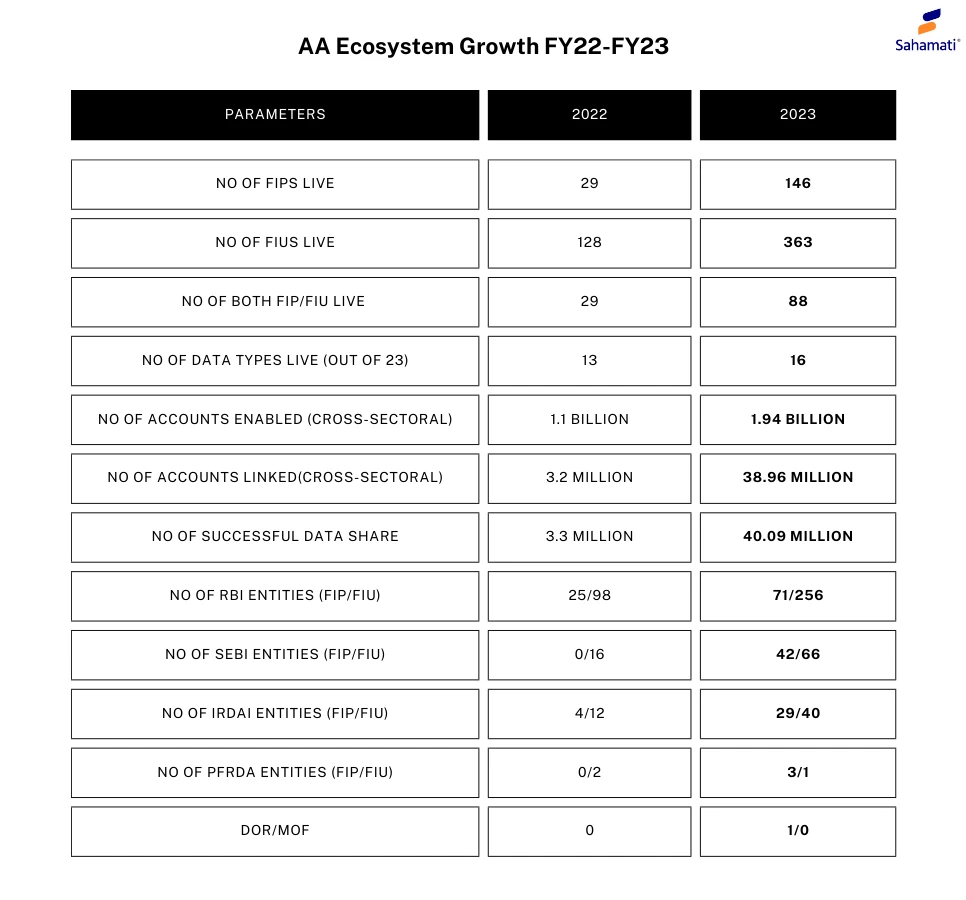

In the last year, the Account Aggregator (AA) ecosystem has strengthened, with the number of live FIPs growing from 29 to 146, showcasing a growing acceptance and participation in the Account Aggregator framework. Simultaneously, the live FIUs have almost tripled from 128 to 363, highlighting the increasing demand for secure modes of sharing financial data. Moreover, the reciprocal entities functioning as FIP and FIU have grown substantially, jumping from 29 to 88. This surge indicates a convergence of roles within the ecosystem, fostering a more interconnected and collaborative financial landscape. As the AA framework witnessed significant adoption across sectors, the number of successful data shares has skyrocketed from 3.3 million to 40.09 million, underlining the robustness and reliability of the system.

Cross-Sectoral Adoption

In just one year, the number of FIPs under the RBI more than doubled, jumping from 25 to an impressive 71. Simultaneously, the number of FIUs also experienced substantial growth, increasing from 98 to an impressive 256.

In 2022, SEBI had no entities participating as FIPs in the AA ecosystem. In one year, the FIPs had climbed to 42. Simultaneously, the number of entities acting as FIUs increased from 16 to 66, signifying a substantial increase in active participation from REs under SEBI.

At the end of 2022, IRDAI had 4 entities as FIPs and 12 as FIUs. By the close of 2023, the numbers increased with 29 entities as FIPs and 40 as FIUs. With the insurance schema from ReBIT in place, the uptake in the insurance sector can be the story this year.

In the last year, entities under PFRDA had not registered as FIPs, while only 2 operated as FIUs. This year, the landscape gradually evolved to 3 entities as FIPs and 1 as an FIU. FIU adoption is expected to rise with sectoral regulations in place for FIP and FIU from the PFRDA.

Along with the regulated entities under the four financial sector regulators, talks have been underway with strategic entities under the Department of Revenue (DoR) Ministry of Finance (MoF) to join the AA Network. 2023 marked the first integration of a strategic FIP in the form of Goods and Services Tax Network (GSTN). More strategic FIPs are poised to join the network in the coming year.

Scale and Impact

The growing traction has led financial institutions to increasingly incorporate AA as a primary data collection mode in customer-facing product journeys. Access to digital, real-time, secure, and authentic data has translated into lower processing costs and reduced risk for financial institutions. This, in turn, has enabled them to cater to customer segments traditionally deemed risky, facilitating small-ticket loans.

This adoption of AAs is expected to have a multiplier effect on the growth of the financial sector. To give a sense of scale and impact,

- Rs 120-140 billion worth of credit was disbursed till December 2023, utilizing data via AA for underwriting.

- Over 40% of the loans disbursed targeted MSMEs, significantly reducing the credit gap in this crucial sector.

- A prominent private sector bank achieved a 25% reduction in application process costs by seamlessly incorporating AA into their procedures.

- Lenders have reported zero fraud rates on bank statements shared via AA, streamlining processes and enhancing overall speed and efficiency.

- An investment advisor observed a remarkable ~60% increase in user engagement as individuals linked their financial accounts via AA, fostering continued visibility and better control over their financial planning.

Way Forward

This marks scale and impact is only the very initial phase. The ecosystem is poised for significant growth across the financial sector. The anticipated growth over the next five years includes an impressive 10,000 financial institutions and a robust four billion financial accounts.

India spearheads a transformative financial revolution, empowering consumers to leverage their informational capital instead of traditional physical collateral. Account Aggregators (AAs) have played a pivotal role in granting individuals control over their disaggregated “data capital” while ushering efficiency, security, and innovation into the financial landscape. With the Digital Personal Data Protection Act (DPDPA) 2023, this revolution is poised to extend its impact beyond the financial sector.

As the industry alliance for the Account Aggregator (AA) ecosystem, we are excited to participate in this growth journey and contribute to the limitless possibilities AAs offer customers!