The first Pragati Session of 2025, hosted in partnership with Finarkein Analytics, took place on Thursday, January 30. This insightful session, titled “Account Aggregator 360°: Status, Use Cases, and the Road Ahead,” provided a comprehensive overview of the AA ecosystem’s journey in 2024 and the exciting opportunities that lie ahead.

Keynote Address by Shallu Kaushik, Chief Digital Officer, Tata Capital

Shallu Kaushik delivered an impactful keynote, emphasizing how the Account Aggregator (AA) framework is reshaping financial transactions in India, from lending to personal finance management (PFM). She highlighted its cost-saving benefits for both customers and financial institutions, as well as the time efficiencies it enables.

She also pointed out the environmental impact of the AA framework, noting the reduction in the carbon footprint due to fewer printed bank-related documents. As the ecosystem matures, she suggested that measuring and tracking this impact would be crucial. Reflecting on the past few months, she acknowledged the significant growth in the AA framework and encouraged financial institutions to actively implement and leverage it in their operations.

Transforming India’s Financial Services

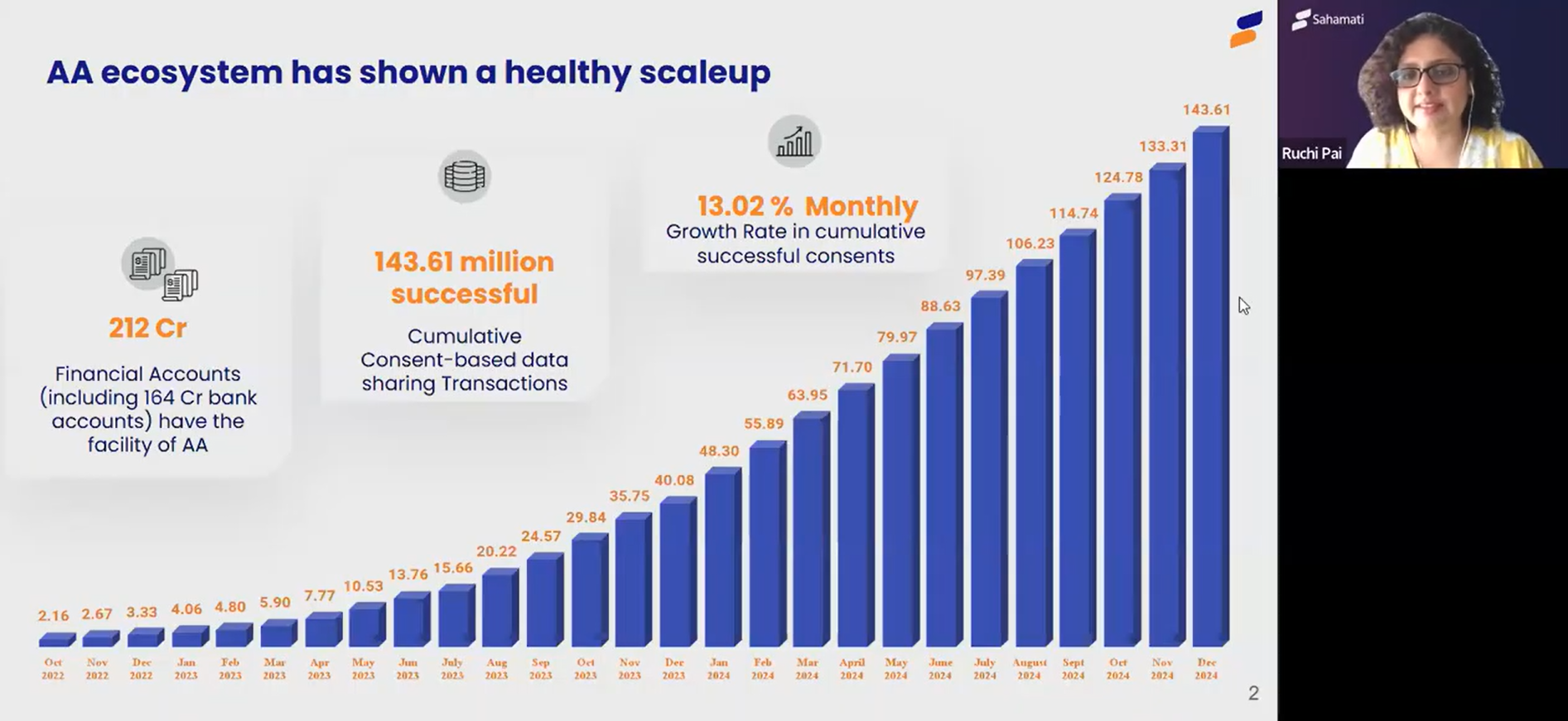

Following the keynote, Sahamati presented key insights into the evolving role of the AA framework in transforming India’s financial services landscape. The discussion covered the major paradigm shifts over the past year, including the following trends:

1. Supply on the AA Framework has strengthened significantly and is further

improving

2. Use Cases have expanded beyond Underwriting and Personal Finance Management

3. Ecosystem has done significant work towards ensuring “Fair Use of AA” via participatory governance

4. Sahamati is working on a technical solution for easy and efficient interoperability

5. The AA Framework is largely aligned to the era of the DPDP Act and is geared to stand the test of Data Privacy

The presentation underscored the growing adoption of AA across financial institutions and its role in enhancing secure, efficient, and seamless data sharing in the ecosystem. The deck presented at the Pragati session can be accessed here: Pragati Session on AA 360

TSP Spotlight: Metisintellisystems Pvt Ltd

The session concluded with a Technology Service Provider (TSP) Spotlight by Metisintellisystems Pvt Ltd, a fintech specializing in AI and ML-driven solutions for the BFSI sector. Their presentation focused on how their technology addresses challenges in the lending ecosystem, streamlining processes and improving credit decisions.

The session provided valuable insights for financial institutions, fintechs, and industry stakeholders, reinforcing the Account Aggregator framework’s critical role in shaping the future of digital finance.

Missed the session? Watch the full recording here: https://youtu.be/z8t6G0co8Vg