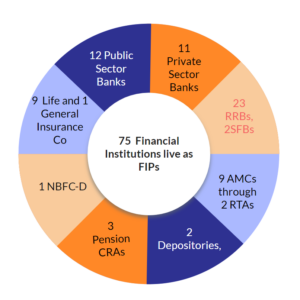

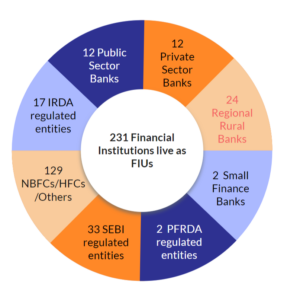

The Account Aggregator (AA) ecosystem has been on an exponential growth curve in the past year. As of 30th June 2023, 75 cross-sectoral financial institutions are live as financial information providers (FIPs) on the network. Similarly, 231 cross-sectoral financial institutions use the AA network as financial information users (FIUs). Currently, many financial information (FI) data types are already live on the network, such as Deposits (Singly held savings a/cs & sole-prop current a/cs), Term Deposits, Recurring Deposits, Equity Shares (Demat), Mutual Funds Units (Demat), Insurance Policies, Unit Linked Investment Plans (ULIPs), and Balances under National Pension System (NPS).

Mutual Fund Units & SIPs data from 9 AMCs (Asset Management Companies) have been integrated into the AA network through the 2 RTAs (Registrar and Transfer Agents) that have joined the network as FIPs. This data opens up possibilities for multiple cross-sectoral use cases for the AA ecosystem.

Harsh Roongta, the guest speaker, eloquently conveyed the potential of AA to revolutionize investment advisory, democratize access, and drive innovation in the financial sector. With data-driven insights and client-centric approaches, AA represents a transformative force that will shape the future of financial services in India and beyond. With mutual fund data as a significant milestone in the AA journey, he emphasized the importance of population-scale digital public infrastructures (DPIs) and how AA plays an essential role in completing the puzzle.

Harsh highlighted the client as the central figure in this revolution, emphasizing that client-consented data flows open the door to exponential innovation. Wealth advisory professionals are eagerly embracing AA, recognizing its potential to disrupt an otherwise elitist profession burdened by high costs associated with data gathering and other operational expenses.

The AA framework is set to democratize investment advisory, benefiting retail players as all data can be collected with user consent. Risk profiling, goal setting, and real-time assessments of current and recommended asset allocation can be seamlessly achieved through AA, eliminating the need for multiple intermediate and time-consuming steps currently involved in accessing data. He further emphasized the transformative impact of AA by highlighting its potential in insurance need analysis. By leveraging data for assessment, AA can revolutionize traditional practices and change how things are done.

The imminent passing of the Digital Personal Data Protection Bill will broaden the scope of AA’s applicability, fueling a flurry of action beyond the financial industry. He stressed that sitting on the fence is not an option; with India leading the change, the world will inevitably follow suit.

As India’s per capita income rises toward US $5000, the demand for discretionary services, including financial services, grows exponentially. Additionally, an aging population necessitates these services even further. AA will play a vital role in this transformative juncture, facilitating these much-needed services and driving significant change in the financial landscape.

Session on Mutual Fund Data

Pragati is a monthly open-house session arranged by Sahamati, the industry association for the Account Aggregator ecosystem, to update the industry on recent developments in the space. On 13th July 2023, a deep dive into the functionality of Mutual Fund data was organized as a part of the Pragati sessions.

The event witnessed more than 250 participants from various financial institutions and TSPs across the sectors. The guest speaker discussed multiple mutual fund use cases and demonstrated a wealth management use case. Let’s take a look at a few of the use cases:

- User Onboarding: Currently, a penny-drop process is used for account verification. Or else the customer must share an account statement or a canceled cheque for the bank account verification. The success rate for penny drop is around 80%, and the canceled cheque verification takes significant time (1-2 days). By using AA, the success rate can be improved to 100%. At the same time, bank validation costs can also be reduced.

- Credit Reconciliation: It employs a semi-automatic, time-consuming process employed by AMCs & RTAs that involves machines and humans that use PDFs and OCR. This process is prone to human error and delays in unit allocation. AAs can improve time allocation by using bank statements & transaction files, ultimately mitigating the risk of human error.

- Notify before Payment Commitments: Investors have drawdown commitments for AIF and SIP installments. When a customer misses an installment payment due to insufficient balances in the bank account, charges are levied on the customer. AAs can enable AMCs to analyze customer bank statements and notify investors with inadequate balances. This will reduce the SIP bounce rate for AMCs, and customers can avoid charges levied on them.

- Consolidated 360° view of Investor Portfolio Dashboard: Managing investments across multiple Mutual Funds and SIPs is complex and time-consuming. RIAs request consent from investors to pull consolidated account statements (CAS). AAs enable seamless data fetch and 360° visualizations to review asset allocation and portfolio growth, powering RIAs to rebalance portfolios & recommend investments.

- Analytic Model-based products: Based on bank statements & current mutual fund and SIP data, AI/ML-based analytics can accurately identify cross-sell and up-sell opportunities for AMCs, wealth managers, and other financial institutions.

- Lending: Integration of mutual funds & SIPs data creates a possibility of lending against mutual funds since AA provides information on lien-marked units. Also, by analyzing customers’ account statements, AAs enable assessing capabilities for loan repayment.

- Insurance: AAs power personalized product pricing offers to customers basis their investment behavior and commitments. This will increase the customer base for the insurance industry.

The discussion also shed light on mutual fund and SIP data schema details.

Let’s briefly touch down on them:

- Profile: This includes personal data such as an Address, Date of Birth, Email, Mobile number, and PAN, as well as account information such as KYC details, Folio number, and Nominee details.

- Holding Summary: Here, summary information of holdings such as AMC details, Scheme Details, Folio number, NAV, Closing Units, Registrar Information, Lock-in Period, and Lock-in Units are reflected. This schema also shows aggregated Portfolio Value and the cost value of investors in the scheme invested in & in every Mutual Fund House.

- Transaction Data: This data includes the dates of transactions along with unique transaction ID, amount, units, NAV, type of transaction, AMC name, and scheme details. It also contains information such as lock-in Units and lock-In period for ELSS, which is helpful for loan against securities use cases.

- SIP Data: The data under this segment, such as amount, number of installments, completed installments, the start date, installment day, pending Installments, and last & next installment date, helps establish monthly commitments of investors.

Check out & download RBI-regulated AA Apps here → https://sahamati.org.in/aa-apps/