In November 2022, RBI notified that GSTN will be a Financial Information Provider (FIP). AA ecosystem was abuzz with the word GSTN. Sahamati hosted an open house which saw more than 300 registrations from financial institutions from various sectors, keen to have GSTN as FIP. In this post lets delve a little deeper into what it means to have GSTN as an FIP.

What is GSTN ?

GSTN is a government enterprise that oversees the levying and collection of GST (Goods and Services Tax) in the country. Being the apex body for indirect taxation in the country, GSTN is also repository of tax payer data.

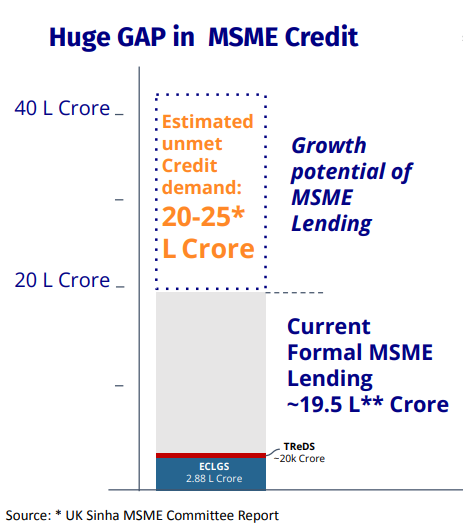

GSTN on AA: A big enabler for MSME Credit

GSTN has more than 13.8 million registered taxpayers who can directly benefit from AA’s consent based data sharing, especially during cash flow based lending such as invoice financing, unsecured business loans and working capital limits.

With GSTN on board, AA will help the MSMEs move from collateral based lending to information based lending. It also provides for a secured, consented process with significantly lower friction vis-a-vis existing lending channels.

Lenders of MSMEs will benefit from the improved viability to enable instant, small ticket loans for MSMEs and advisories can explore avenues for avenues for cash flow based advisory to MSMEs.

Click here to view the Sahamati’s presentation on GST as FIP or watch it on Youtube.

GSTN as FIP: Scope of data to be shared

While RBI comes up with the updated data schemas for GSTN, given below is a glimpse of scope of data to be shared on GSTN as approved by GSTN.

GSTR 1 (Table 4) – Monthly or quarterly statement of all Outward Supplies to be furnished by all registered taxpayers

- Details of past and future cash flows of MSMEs

- Details of buyers and invoice data

GSTR 3B – Monthly or quarterly self-declared summary of GST

- Summary figures of sales, purchases, Input tax credit claimed, and net tax payable

- Aggregated turnover of the taxpayer and his tax compliance behaviour

Return Filing Details

- Date of return filing by the taxpayer in each return period

- Input Tax Credit

Basic Profile Details

- Includes profile data such as address, Legal name of the entity, and PAN

- Business continuity of the taxpayer with his self declared information and other documents such as PAN, bank statements and credit reports.

GST Schema

Click on the link here to get the full List of data fields / Data Schemas.

The XML schema is being reviewed by ReBIT and the same is made available here for reference.