Account Aggregators are the

Future of Data Sharing

digital financial data from one or more accounts, and delivers it to the financial

institution that is providing services like loan or insurance to you.

Know More About the

AA Participants

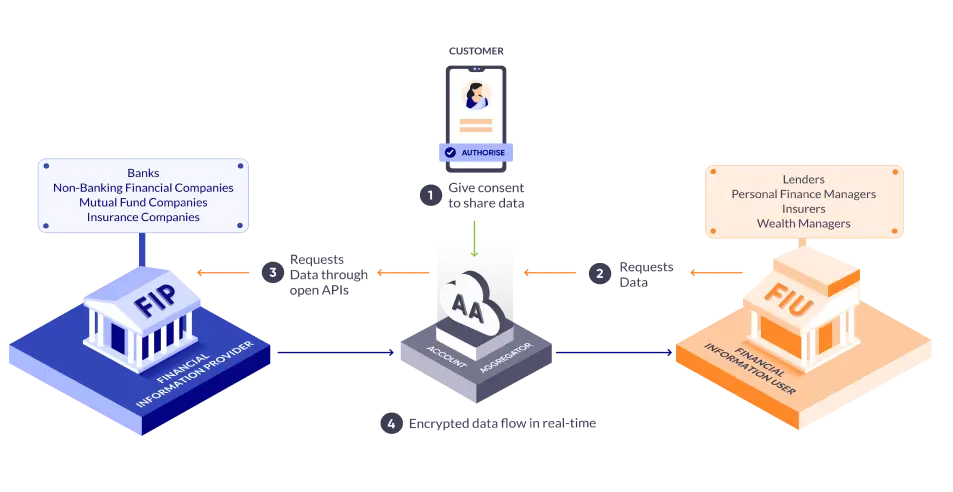

The main participants of the AA ecosystem are the Account Aggregator (AA), the Financial Information Provider (FIP) and the Financial Information User (FIU) working together to simplify the process of sharing data.

An Ecosystem that lets You be in

Control of Your Data, Always

AA cannot share your data

without your consent

AA does not store or process

your data

All your financial data is encrypted with the AA

Give or revoke access to your

active consents anytime

The Advantages of the

AA Framework

Just like UPI completely transformed the way you pay, AA can make financial services like loans and credit

facilities much more seamless and accessible for everyone using the existing digital infrastructure.

Hassle-free

AA makes it effortless to gather data at the user’s end and enter data at the service provider’s end.

Fast

AA allows faster processing, and quicker access to products or services.

Comprehensive

With entire financial profile at one place service providers gauge your needs in a better way.

Real-Time

Information for each synced account is up-to-date, and available online reducing margin for errors.

Verified

Financial data is directly delivered from authorised accounts eliminating data errors.

Transparent

Aggregation increases transparency by helping you get better picture of your finances.

See How it Works

From business loans to personal insurance, the AA framework

can be easily adopted into different products and offerings for

your individual and business needs.

An RBI Regulated Entity

RBI issues Account Aggregator Licenses

AA Tech is based on DEPA consent layer API

AAs were created through an inter-regulatory decision by:

Reserve Bank of India (RBI) | Pension Fund Regulatory and Development Authority (PFRDA) | Securities and Exchange Board of India (SEBI) | Insurance

Regulatory and Development Authority (IRDAI) | Financial Stability Development Council (FSDC)