The 1059% growth in FY 2023-24 makes it the fastest growing Open Finance Network in the World

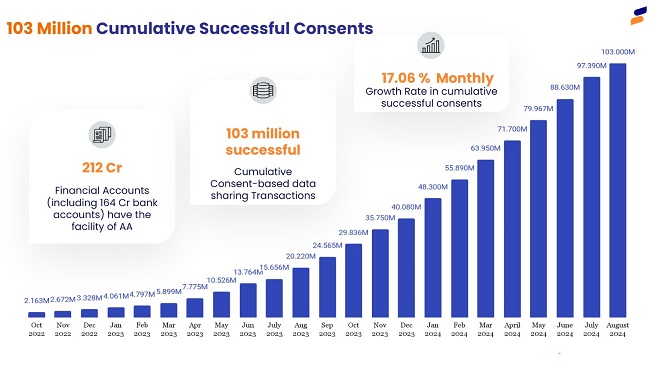

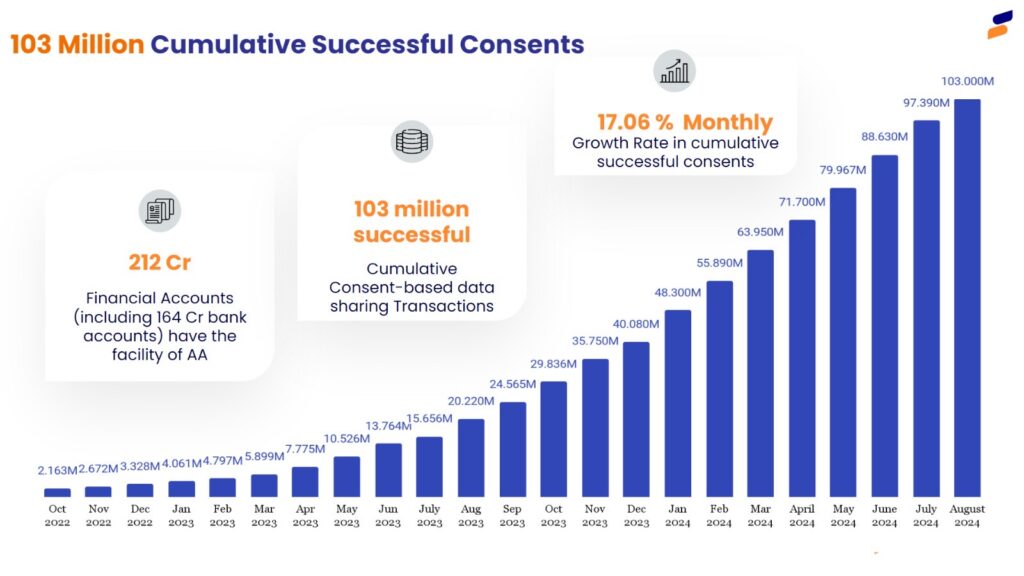

Bengaluru, 20, August 2024: Sahamati, the market-led industry alliance for the Account Aggregator (AA) Ecosystem, today announced that the total number of successful consents on AA Framework has crossed 100 million as of 15th August 2024. Sahamati estimates about 80-90 million people are using AA, which translates to 8% of the adult population of India. In the financial year FY 2023-24 (April 2023-March 2024), AA consents grew by 1059%, which signifies the phenomenal adoption and inroads of Open Finance in India. It also makes India’s AA ecosystem, the fastest growing Open Finance ecosystem in the world.

According to Sahamati’s market intelligence, the current usage and penetration of Open Finance/ AA Framework are expected to reach 15-20% of the Indian adult population by FY25 and 25% by the end of 2025.

Internationally, Open Finance is defined as a framework that allows customers to share their financial data with third-party providers, enabling the development of new financial products and services. However, worldwide, consent management is entrusted to the Financial Information Users of Open Finance Frameworks. In India, Account Aggregators act as consent managers independent of Financial Information Users (FIUs), that enable individuals and businesses to share their financial data with their consent and manage their consents at one place.

Said B.G.Mahesh, CEO, Sahamati, “The metrics of growth on all aspects have been encouraging. The use cases have been expanding with FIUs using AA for streamlined tasks like customer onboarding to specialised tasks like controlling frauds. Growth in consent requests from 5.5 million in FY 2022-23 to 63.75 million in FY 2023-24 by customers indicates a higher degree of comfort and acceptance of the system. Our goal is to make AA accessible to customers in the remotest parts of India, democratising financial services and data sharing.”

He added, “With over 80-90 million people using Account Aggregators (AA) and surpassing 100 million consents, the Account Aggregator ecosystem has become the world’s largest Open Finance ecosystem, a remarkable achievement.”

The usage has expanded from the basic use case of underwriting loans to personal finance management, portfolio management, assessing early warning signals and monitoring of loan accounts, loan collections, issuance of insurance policies, opening of demat accounts and investment advisory.

Additionally, the availability of authentic and real-time data is expected to have a significant impact in making financial services accessible to the 800 million underbanked population of India. For instance, just for credit, at scale, the AA Framework is expected to be the critical catalyst to improve the credit-to-GDP ratio significantly in the coming years. Sahamati believes the current usage and penetration of Open Finance/ AA Framework is just the beginning and will continue to grow at a rapid pace.

About Sahamati

Sahamati is a member driven industry alliance, that works across the three verticals: advocacy, shared techno-legal services and participatory governance all aimed at empowering customers with their own data via the AA Framework. Sahamati is incorporated under Section 8 of the Companies Act 2013, dedicated towards institutionalising consent-based data-sharing mechanisms through the AA framework.

As of August 2024, the Account Aggregator ecosystem had-155 FIPs (Financial Information Providers) across banks, insurance firms, investment, pension and taxes and 475 FIUs (Financial Information Users).

To know more about the ecosystem, contact us at info@sahamati.org.in

Media Contact: Nisha Khetan +91 98203 48387; nisha@cubicpr.com